Adyen Adapter

Overview

Adyen is a global payment company that offers a platform for businesses to accept e-commerce, mobile, and point-of-sale payments. Adyen is notable for its seamless integration options that support processing payments across online, mobile, and in-store channels. The company is headquartered in Amsterdam, Netherlands, and serves customers worldwide, including major international brands.

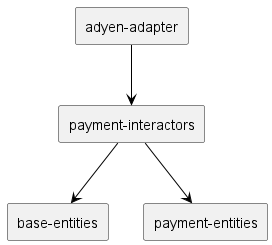

Dependency Graph

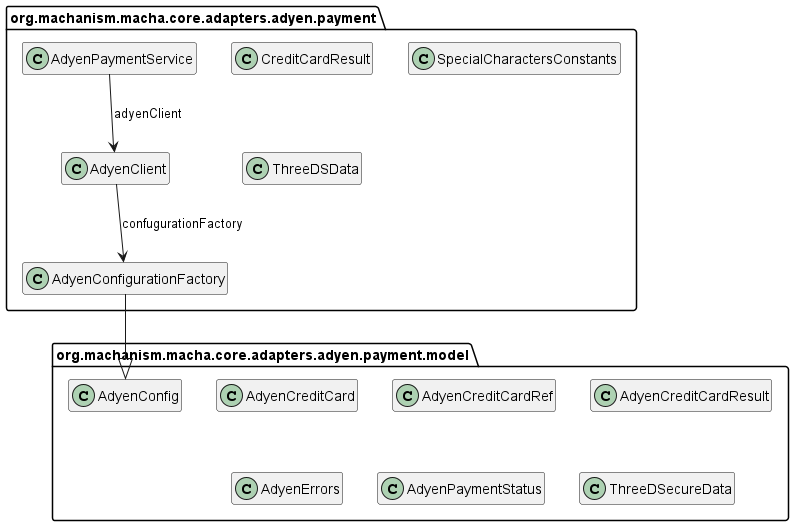

Class Diagram

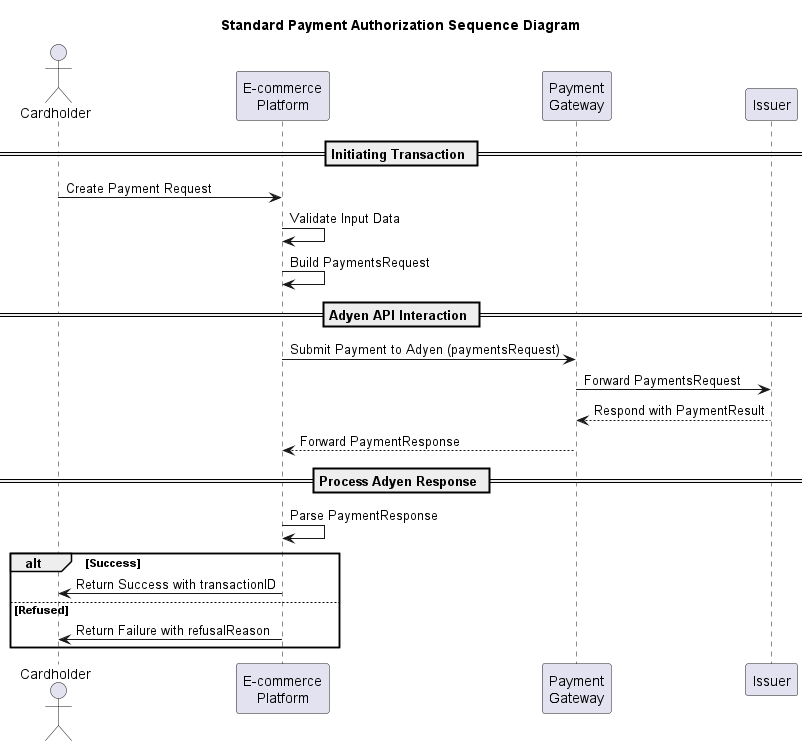

Standard Payment Authorization (Non-3DS)

A Non-3D Secure Payment Transaction is a straightforward payment process where cardholder details (e.g., card number, expiration date, CVV) are sent directly to Adyen for authorization without any additional authentication steps like 3D Secure. Adyen evaluates the transaction request and responds with an authorization result (approved, refused, or error), providing a fast and seamless experience for customers. This type of transaction is typically used for low-risk payments or scenarios where extra verification is not required.

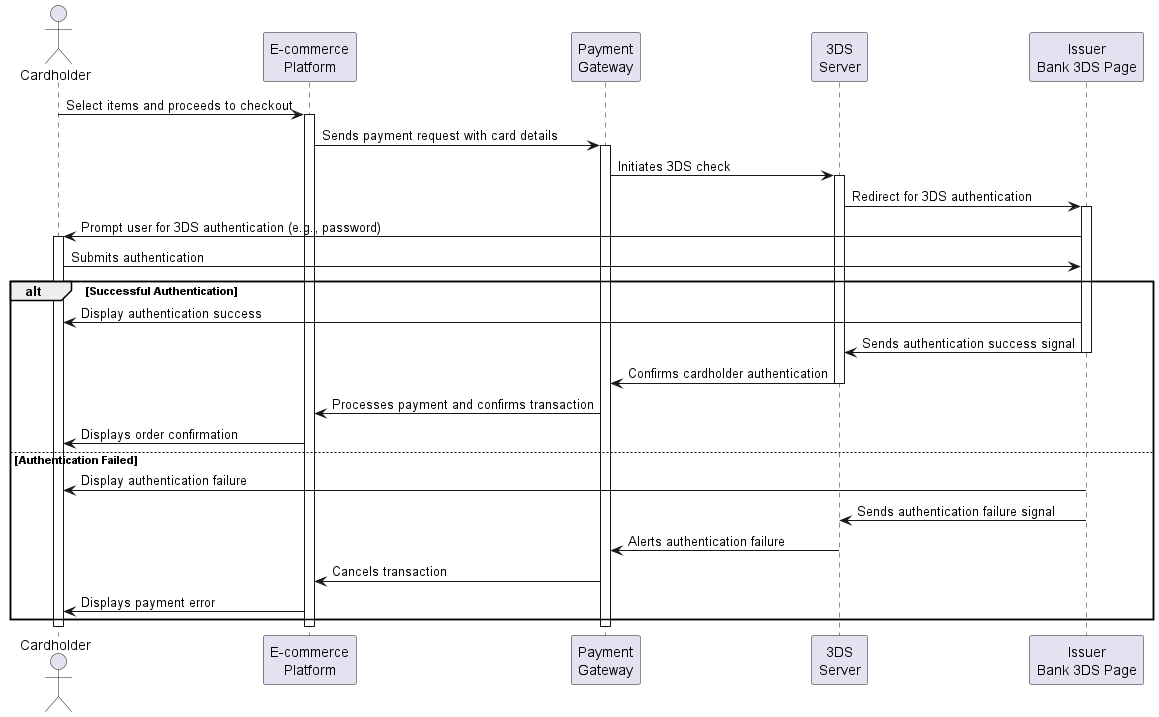

3D Secure 1 (3DS1)

3D Secure 1 (3DS1) is the first version of the Three-Domain Secure protocol, a security standard that enhances online credit and debit card transactions by adding an extra layer of verification. The protocol involves three parties: the acquiring bank, the issuer bank, and the interoperability domain (such as Visa or MasterCard networks). During a 3DS1 transaction, cardholders are redirected to their issuer’s verification page to authenticate the payment using methods like a password or security code, ensuring additional protection for online purchases.

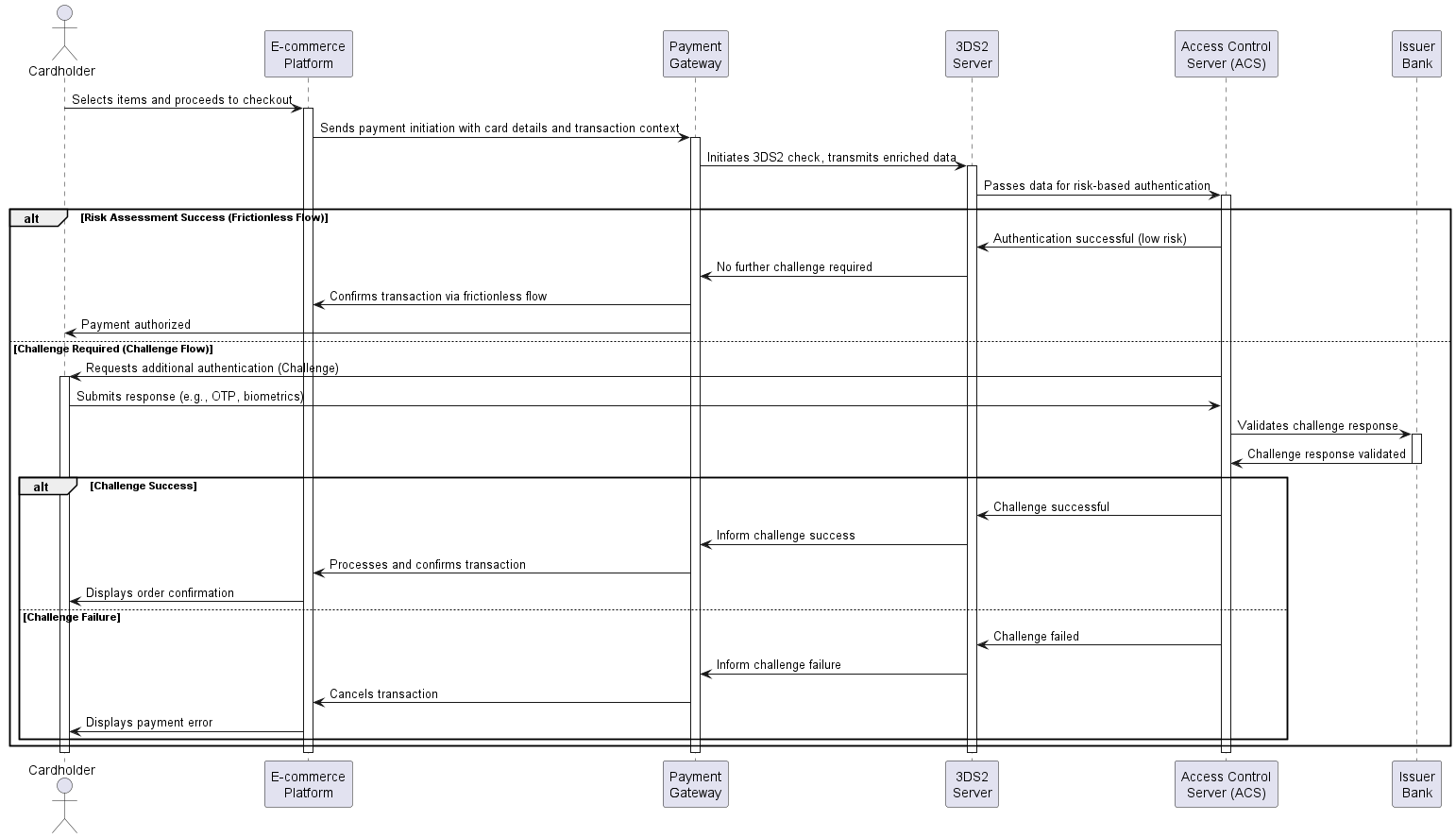

3D Secure 2 (3DS2)

3D Secure 2 (3DS2) is the enhanced version of the Three-Domain Secure protocol, aimed at improving the security and user experience for online credit and debit card transactions. Unlike the older 3DS1, 3DS2 leverages frictionless authentication and richer data exchange between merchants and issuers, allowing most transactions to be verified without redirecting customers to an external page. For higher-risk transactions, layered authentication methods like biometrics or OTPs are used. It’s designed to reduce cart abandonment while maintaining strong security standards and compliance with regulations like SCA under PSD2.

Macha

Macha